[openai_chatbot] rewrite this content and keep HTML tags as is:

This week, I’m joined by Rob Smith, boss man of Hunters, Whitegates & Northwoods, as we delve into the key property market headlines for the week ending on 8th June 2025.

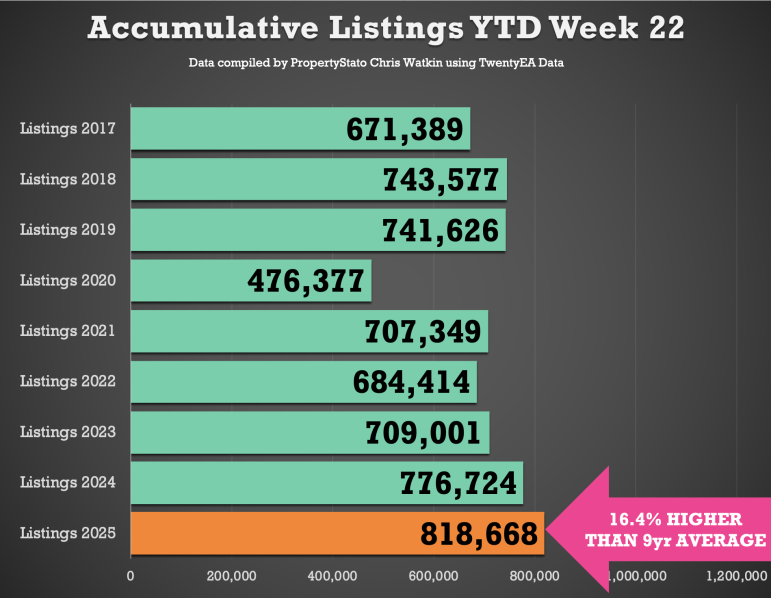

✅ Listings (New Properties on the Market)

39.3k new listings this week (last week 31.9k – which was a Bank Holiday)

YTD 6% higher than Week 22 of 2024 YTD and 8% higher YTD compared to 2017/18/19.

✅ Price Reductions (% of Resi Stock)

27.9k Price Reductions this week (last week 21.9k – again Bank Holiday the week before)

Monthly Run Rate in reductions – 1 in 7.1 of Resi Sales stock per month is being reduced (which represents 14%) …13.4% the month before

For comparison, 12.1% average in 2024, though the long-term 5-year average is 10.6%.

✅ Total Gross Sales (Agreed Sales)

28.6k UK homes sold STC this week (last week 25k)

YTD – The number of Sold STC Resi homes are 8% higher compared to 2024 (581k Sales agreed YTD 2025 vs 535k YTD 2024) and 16% higher than 2017/18/19 YTD levels (499k).

✅ Sell-Through Rate (Monthly in Arrears)

May’s sale run rate of 16.08 of Resi stock sold stc (ie 16.08% of Estate Agents properties on the market went sale agreed). 15.36% last month

2024 monthly average: 15.3%. Long term 8 yr average: 17.9%.

✅ Sale Fall-Throughs

6,713 Sale fall-thrus last week from Resi Sale Sales Pipeline of 479k UK homes sale agreed (sold stc).

Another method is that week’s sale fall thrus as a % of gross sales that week. This week, that is 23.5% (last week 21.7%). That is below the 7-year average of 24.2%, and well below the 40%+ levels post-Truss Budget (Autumn 2022).

May’s figure 5.84% of sales in the UK agents pipelines fell thru. For comparison, April ’25 – 5.51%. 2024 average: 5.36%.

✅ Net Sales (Gross sales for the week less Sale Fall Thrus for the week)

21.9k net sales this week (19.6k last week), compared 2025 weekly average of 20k.

2025 YTD is 6% higher than compared to 2024 YTD and 11.2% higher than YTD 2017/18/19.

✅ Resi stock levels and sales pipeline StatsResi

As of 31st May 2025

✅ Average rents by UK region since 2016

Local Focus this week

Stockport

[/openai_chatbot]

#happening #property #market