A takeover battle erupted over Hipgnosis Songs Fund today, after private equity giant Blackstone revealed it had made a rival bid for the investment trust.

Last week, Concord Music, an American independent music company, made an offer for the music library of Hipgnosis, valuing it at $1.4bn (£1.1bn).

The board of Hipgnosis then unanimously recommended the offer, with chair Robert Naylor saying it was confident that Concord “is the right owner to take on the Hipgnosis catalogue and manage it in the interests of composers and performers”.

Now, Blackstone, who is the majority owner of the trust’s investment adviser Hipgnosis Song Management (HSM), has made a $1.5bn offer for the music catalogue trust.

The American private equity firm revealed today that it had made a series of proposals to Hipgnosis for its entire portfolio, with today’s offer being the fourth.

“Blackstone strongly encourages the board of Hipgnosis to recognise the significant increase in value available to all shareholders under the terms of its fourth proposal, over the $1.16 as set out in the Concord offer, and to work with Blackstone to reach agreement on a unanimously recommended firm offer in an expeditious manner,” Blackstone said.

Sky News has reported that previous offers by Blackstone ranged between 82 to 88 pence per share, less than the 93.2 pence bid from Concord.

However, today’s deal, which is about seven per cent higher than Concord’s, leaves the trust at the centre of a bidding war.

The board of Hipgnosis and its Blackstone-owned adviser have frequently clashed in recent months, taking potshots at each other as the relationship has grown increasingly tense.

Most recently, an independent valuer found that the trust’s adviser had inflated growth figures and overstated the value of its portfolio, with the board fully accepting the report.

The independent valuer Shot Capital slammed HSM for falling “below industry standards”, adding that it had “failed to invest in systems and provide the services required to effectively manage a catalogue of 40,000+ songs”.

Today, Blackstone acknowledged a clause in the contract between Hipgnosis and its adviser that on the termination of its investment advisory agreement (IAA), it has a six month window to purchase the trust’s entire portfolio of songs, at the same price offered by Concord.

“Blackstone and its portfolio company HSM, having taken extensive legal advice, remain confident in the enforceability of the option,” said the firm.

“Blackstone is seeking to find a positive outcome for all shareholders at a fair and reasonable value; however, Blackstone and HSM value the contractual protections under the IAA and will vigorously defend HSM’s rights pursuant to the option if required to do so.”

However, this call option has been reported to no longer be valid if the management contract is terminated for cause.

Blackstone will now wait for the UK Takeover Panel to set a date by which the firm must make a firm offer for the trust.

The trust’s stock price currently sits at 91.5p, having spiked almost 30 per cent following the Concord offer.

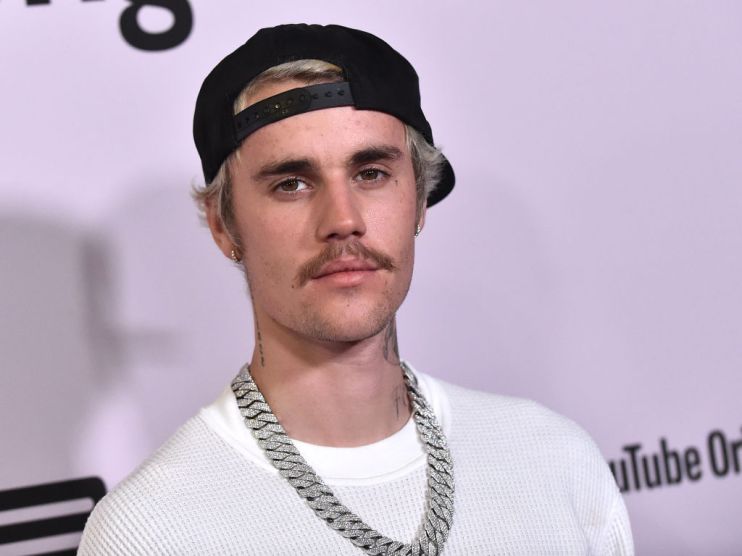

Artists included in the catalogues of Hipgnosis include Justin Bieber and Mark Ronson.