Brits spent almost £1bn on flowers, gifts, and at-home meals this Valentine’s Day as shoppers sought to create a special occasion at home rather than splashing out at a restaurant.

According to the latest NIQ Till Tracker, £962m was spent on food and gifting on Valentine’s Day, with the biggest growth in spending on flowers, toiletries, and perfumes.

“Retailers capitalised on the opportunities around Valentine’s Day… With the pinch of the cost of living, many shoppers dined in to save money this year, with premium food options growing and themed meals and gifts very much in vogue for treating loved ones,” Mike Watkins, Head of Retailer and Business Insight at NIQ said.

Around a quarter of purchases were for promoted goods, NIQ found. This trend to focus on value-for-money purchases has been ongoing since the pandemic, but gained steam again last September as consumer confidence dropped.

The tail end of the cost-of-living crisis has proved sticky, with inflation at 3.3 per cent in February and consumer confidence in the economy now lower than a year ago.

Watkins warned that with energy and council tax bills also set to rise in the coming months, “shoppers will [still] be looking carefully at their discretionary spend.”

The energy price cap will rise by 6.4 per cent in April due to a pike in the wholesale cost of energy, while council tax in London will rise by four per cent.

The premium grocers, offering high-quality take-home meals, saw the most year-on-year growth in February.

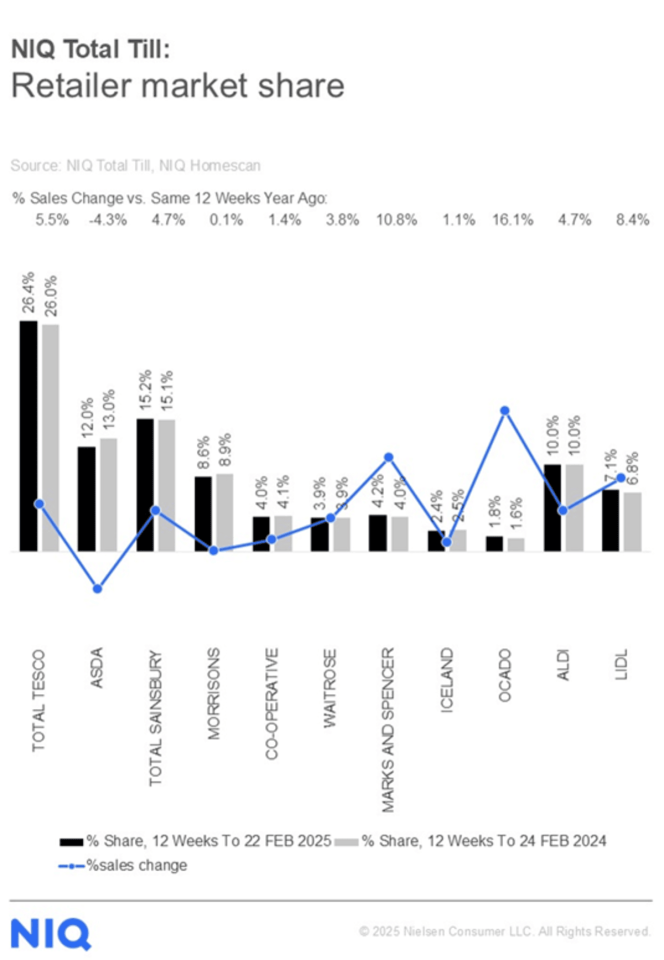

Sales at Tesco rose by 5.5 per cent year on year and comfortably accounted for over a quarter of the market. This was, however, slightly below the group’s overall grocery market share of 27.8 per cent.

Sales growth at Ocado and M&S was 16.1 per cent and 10.8 per cent, respectively.

M&S and Ocado have both been boosted by their 50:50 joint venture (JV), which gives Marks the ability to sell products via’s Ocado’s delivery service. Ocado has a similar JV with Morrison’s.

The strong results for M&S, accounting for around a tenth of the market, also suggest that its premium rebrand, which has been underway for half a decade, has paid off.

Sales at Asda, however, have slumped again. NIQ’s results echo data from Kantar, which found that Asda’s market share has slumped by about five per cent in the last year.

Asda has struggled with the rise of discounters Lidl and Aldi, as well as with high debt, strikes, and an expensive detachment from its previous owner’s IT systems.