| Updated:

The untrammelled ascent of bitcoin has occupied the attention of many market watchers of late, with Donald Trump’s election to the White House sending the cryptocurrency – and others like it – on an eye-watering tear.

Bitcoin has risen nearly 50 per cent since November 3 – the eve of the US election – while Dogecoin, a so-called ‘memecoin’ which many crypto investors associate with Elon Musk, has more than doubled in the same period.

But despite crypto dominating the column inches, there has been another unconventional asset class that has had a blistering year: gold.

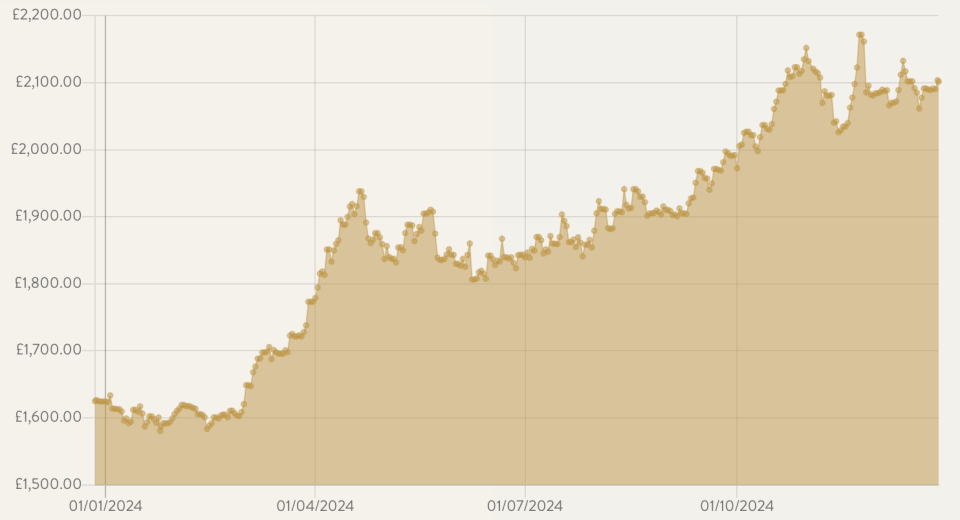

Prices for the yellow metal have risen nearly 28 per cent in sterling terms, as investors retreat back to the traditional safe haven amid an uncertain geopolitical and economic climate.

Having started the year changing hands at £1,602 per ounce (/oz), gold hit several all time highs throughout 2024 during a bull run that reached its apex of £2,163/oz in late November before tailing off to 2,071/oz at the time of writing.

Such a sizeable jump across the year would usually precipitate prices coming back down as investors shy away from its higher price; a trend that has been partially vindicated by the asset class’s dip in the last month.

But with geopolitics set for another febrile year, and inflation looking increasingly embedded in many western economies, many investors in the precious metal are predicting another year of gains in 2025.

A ‘record breaking’ 2024

“There’s no denying that 2024 has been a record year for gold,” says Rick Kanda, managing director of The Gold Bullion Company. “It’s reached colossal new highs and broken records. This is… a result of economic uncertainty, changes in global inflation and also increased demand.”

Gold has traditionally performed especially well in times of uncertainty, when investors look allocate less of their portfolio to jittery equity and bond markets.

The consensus view that gold holds an inherent value – thanks both to its practical use in jewellery and several tech products, and its historical use as a currency – adds to its allure when markets are febrile.

According to Bullion Vault, a UK-based precious metal marketplace, investors don’t envisage that febrile environment dissipating next year. With a capricious President-elect readying himself for another term at the helm of the world’s largest economy, several major conflicts raging into the new year, and inflationary pressures persisting, Bullion Vault’s investors are more likely to consolidate their gold positions than sell out of them.

The firm, which conducts a regular survey of its customers, forecasts gold will reach a high of $3,070 in 2025, with respondents citing geopolitics as the biggest factor driving their interest in the yellow metal.

Adrian Ash, director of research at the exchange, says that Donald Trump’s return to to the White House threatened to “up-end global trade as well as the West’s political and military alliances”, adding: “Investors are taking the potential of precious metals very seriously as a hedge against risk.”

Trump to turn on the taps: Sovereign debt triggers demand in gold

While a febrile international affairs outlook may have been investors’ primary reason for owning gold into the new year, with 31.4 per cent citing it a factor behind their decision to hold the asset, rising sovereign debt was another big driver.

Almost across the board, western economies have overseen a period of widening government deficits, as economic growth struggles to outstrip the constant political pressure to increase state spending.

It is a trend that dates back to the financial crisis in 2007/8, but which went into overdrive during the pandemic, as leaders borrowed at unprecedented levels to keep their economies afloat while many people were unable to work.

As inflation – and then interest rates – crept up as economies unlocked, many government bonds – including those issued by the UK – have fallen to post-crisis lows, as lenders begin to price in the growing risk associated with lending to countries borrowing more and more money.

In a note over the summer, Bank of America analyst Michael Widmer said gold “remained the ultimate perceived safe haven asset” as he predicted it would hit $3,000 within the next 12 to 18 months.

A key factor in Widmer’s bullish intervention was the direction of fiscal policy in the US and beyond. With little sign that either of the then-Presidential candidates wanted to make a concerted effort bring down the US’s gaping deficit, and longer term pressures to spend on climate adaption and ageing populations materialising across the world, Widmer said gold was likely to retain its appeal to investors into 2025 and beyond.

Central banks are ‘bullion hungry’

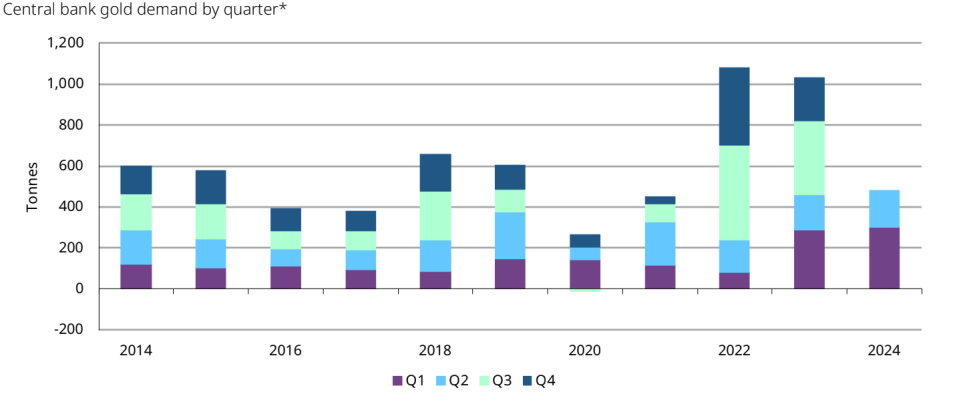

A third key factor rising gold prices last year, during which we saw traditional bars of gold pass $1m for the first time, has been expanding demand from central banks; particularly those that oversee non-Western developing economies.

Due largely to the factors outlined above, there has been trend of de-dollarisation has emerged in many economies that have hitherto relied on the global reserve currency as a store of some of their nation’s wealth.

This discomfort with holding too many dollars was, according to the Money Metals Exchange’s Michael Maherrey, compounded when the Biden administration opted to freeze $300bn of Russian foreign exchange reserves in the wake of its invasion of Ukraine, and subsequently threatened to liquidate them to help fund Ukraine’s recovery.

Weary of the same fate befalling them, other non-western central banks have reevaluated their commitment to dollar reserves since the onset of Russia’s invasion of Ukraine, and bought up more of the precious metal instead.

Even though central bank buying slowed in the third quarter of 2024, economists at ING think central bankers will remain “bullion hungry” in 2025, with the Reserve Bank of India (RBI) and the National Bank of Poland leading the charge.

“Looking ahead into next year, we expect central banks to remain buyers due to geopolitical tensions and the economic climate,” analysts said in a recent note. “A World Gold Council survey conducted in April 2024 found that 29 per cent of central bank respondents intent to increase their gold reserves in the next 12 months.”