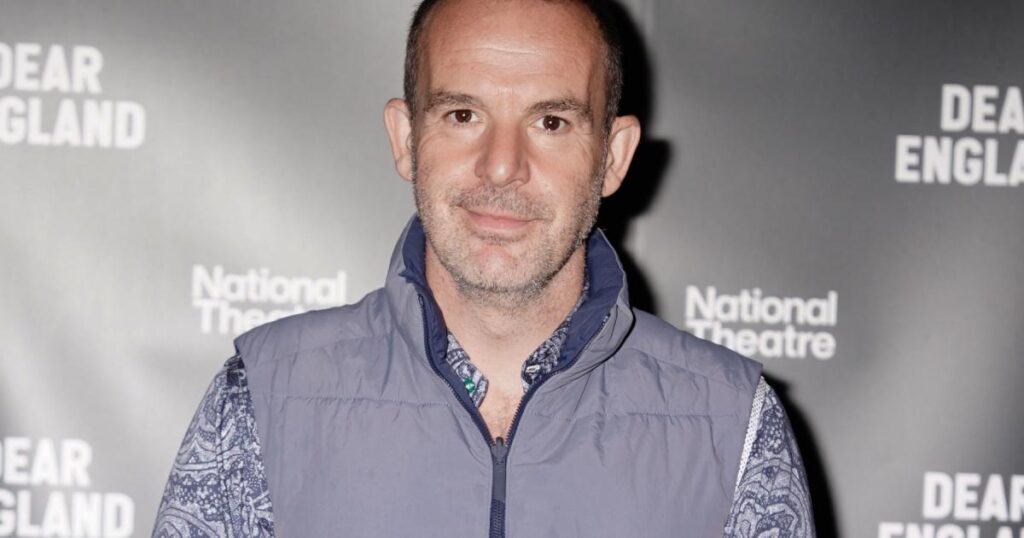

On his Martin Lewis Money Show today (Tuesday, November 26), the 52-year-old encouraged parents to get their children who are aged over 18 to invest money into a Lifetime ISA (or LISA).

A LISA lets you save up to £4,000 every tax year towards a first home or your retirement, with the state adding a 25% bonus on top of what you save.

Therefore, if you put £4,000 in each year, you will get an extra £1,000 on top each time.

The MoneySavingExpert website states: “Plus you earn interest on whatever you save, and as it’s an ISA (Individual Savings Account), that interest is tax-free.”

Anyone aged 18 to 39 can open a LISA, but there are a few caveats that Martin Lewis warned first-time buyers about.

Martin Lewis breaks down LISAs

Lewis shared that there is a withdrawal fee at a rate of 25% if the money invested into a LISA is withdrawn and not used to buy a person’s first property.

Additionally, the maximum property price that someone can buy using the LISA is £450,000.

Recommended reading:

Therefore, any young person opening an account will need to be sure that they’ll put the money saved into buying a first home.

The MSE website adds: “You need to have held a LISA for at least 12 months to be able to use it (and the bonus) towards your first home WITHOUT paying a penalty – use it before and you’ll pay a withdrawal charge, which wipes out the bonus and a bit more on top.”

In terms of interest rates added onto the money saved on LISAs, Lewis shared that Moneybox offers a rate of 4.8% while Tembo offers 4.75%.

Alongside that, the LISA from Paragon has an interest rate of 3.51%.

Source link

[Featured]

[Just In]