Originally published on Unchained.com.

Unchained is the official US Collaborative Custody partner of Bitcoin Magazine and an integral sponsor of related content published through Bitcoin Magazine. For more information on services offered, custody products, and the relationship between Unchained and Bitcoin Magazine, please visit our website.

You don’t often see the term “Roth IRA” trending online, but in 2021, tech investor Peter Thiel made headlines for his $5 billion tax-free Roth IRA piggy bank. How did he do it? The answer is alternative investments. He used a self-directed IRA to invest in early-stage tech companies multiple times over. Is it a loophole? Possibly. But it happened, it got attention, and the IRA structure in question could come under further scrutiny.

“Thiel has taken a retirement account worth less than $2,000 in 1999 and spun it into a $5 billion windfall.” – ProPublica (2021)

Let’s look at six common risks associated with self-directed and checkbook IRAs, how they may apply in the context of bitcoin, and why there may be increased regulation coming in the future. But first, we need to define our terms and differentiate between IRA structures.

The different IRA structures

The different IRA structures can behave in an “every square is a rectangle, but not all rectangles are squares” kind of way. IRAs can be Traditional (pre-tax) or Roth (post-tax) regardless of custodial relationship/structure. All IRAs are custodial. A custodian, in the context of IRAs, is a licensed financial institution overseeing and administering the IRA.

Brokerage and Bank IRAs

Brokerage and bank IRAs are the most familiar and common types. Brokerage and Bank IRAs allow investors to invest in stocks, bonds, ETFs, mutual funds, and other securities, as well as banking products (CDs, deposit accounts, etc.). Examples include your typical Fidelity, TD Ameritrade, or Charles Schwab IRA. The Unchained IRA is closest to this structure in this hierarchy.

Self-directed IRA (SDIRA)

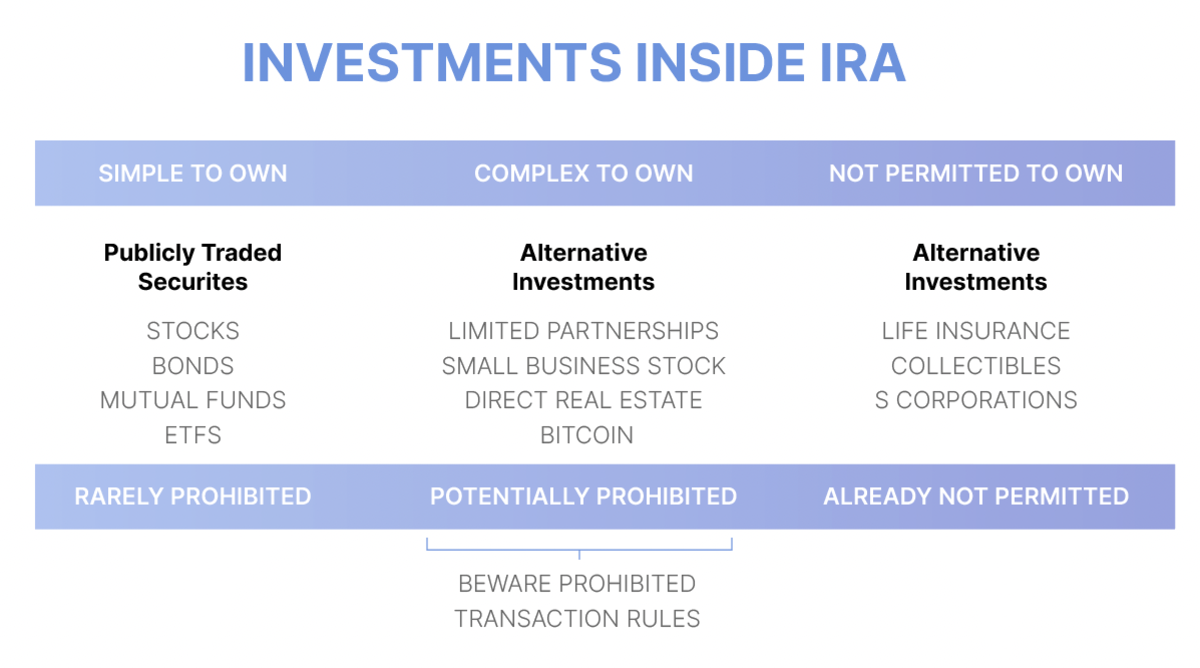

A self-directed IRA is a custodial IRA where the custodian allows for expanded investment options outside of or in addition to typical brokerage and bank assets (stocks, bonds, CDs, etc.). Owners of self-directed IRAs can invest in non-traditional assets like real estate, businesses, private loans, tax liens, precious metals, and digital assets. Although the IRS doesn’t have a definitive list of allowed investments, it certainly has a few that are not allowed (collectibles, life insurance, certain derivatives, S-Corps, etc.).

Checkbook IRA

Checkbook IRAs are a subset of self-directed IRAs. The term “checkbook IRA” is not standard, but it usually refers to a self-directed IRA that gives an account owner control of investments through a checking account, usually through an LLC conduit. The account holder can then make investments with IRA funds simply by writing a check (“checkbook control”). With the added freedom of additional investment choices comes added responsibility of administration, as well as legal ambiguity as to whether the structure still qualifies as a tax-exempt IRA.

Non-checkbook self-directed IRA

A subset of self-directed IRA where the custodian approves transactions before investments are made. Investors must wait for the custodian to review each potential investment and formally accept title to the underlying asset. These were commonly used for real estate and private equity investments and began regaining popularity once additional legal uncertainties arose regarding checkbook IRAs in late 2021 (discussed in section 4 below).

Risks to watch for when using a self-directed or checkbook IRA

1. Liquidity

Unfortunately, many self-directed assets lack liquidity, making them difficult to sell quickly. Examples include real estate, privately held businesses, precious metals, etc. If cash is ever needed for a distribution or internal expense, selling an asset fast could be a problem (which compounds into other problems, i.e., accidentally commingling funds). Self-directed IRA owners should conduct thorough due diligence on asset liquidity before committing to an investment strategy.

2. Formation and legal structure

When forming a checkbook IRA, a self-directed IRA LLC is established first. Then, the LLC establishes a checking account just like any other business entity. Next, the LLC is funded by sending the IRA funds to the checking account.

With the proper legal structure, the IRA owner can become the sole managing member of the LLC and have signing authority over the checking account. However, improper legal structure, registration, or titling could all cause serious problems for the tax-advantaged status of the IRA. Many checkbook IRA facilitators are competent, but errors could always lead to issues and possible disqualification/loss of the entire IRA.

3. Misreporting transactions

Within a checkbook IRA, owners can fund investments quickly and freely, but this comes with the responsibility of properly following rules and self-reporting transactions.

At the end of each year, the owner of the LLC will need to provide complete transaction details to its IRA custodian and submit fair market valuation (FMV) information. Without oversight into each transaction you make, a custodian is more likely to misreport income on your investments. Always ensure the custodian has accurate information to avoid accidentally breaking the law.

4. “Deemed distribution” treatment

Clients looking to buy precious metals, real estate, or digital assets should know the risk of “deemed distributions” treatment. A recent United States tax court case, McNulty v. Commissioner, illustrates the considerable risks of maintaining a checkbook IRA. In the McNulty case, a taxpayer used her checkbook IRA LLC to purchase gold from a precious metals dealer. She stored the LLC’s gold at home in her personal safe. The court ruled that her “unfettered control” over the LLC’s gold without third party supervision created a deemed taxable distribution from her IRA.

It is impossible to know how far a tax court will go applying “deemed distribution” treatment to any given transaction or investment within a checkbook IRA. For checkbook IRA owners that hold the keys to bitcoin in an unsupervised structure, there is a risk that the McNulty ruling could cause your entire IRA to be subject to tax. Further, since alternative investments were fairly recently (2015) added to IRS Publication 590, it’s entirely possible that the IRS and Congress could apply more scrutiny to checkbook IRAs going forward. Read more about the McNulty case and its implications.

5. Prohibited transactions

All self-directed IRA owners are always prohibited from commingling personal and IRA assets or using any personal funds to improve IRA assets. “Self-dealing” is one of the most common pitfalls for self-directed account holders. For example, if you use your IRA to purchase real estate, you are not allowed to use the property yourself—not even a little bit. You cannot live there, stay there, or rent office space to yourself there. You are not even allowed to make your own repairs or provide “sweat equity.”

It’s not only the IRA owner that can’t participate in any “self-dealing,” but spouses, children, and grandchildren as well. They are considered disqualified individuals, and penalties are stiff. These are stringent rules and can result in huge tax headaches if breached. I don’t intend to crush any dreams, but investing your 401k/IRA into your lakefront Airbnb vacation home and having you or your family stay there even once is a bad idea. No purchasing a rental home and renting it out to family members either. For further fun, see the IRS list of prohibited transactions here.

Here are a few examples of how prohibited transactions rules could be applied to digital asset investors:

- Commingling personal wallets with IRA wallets

- Leverage without a non-recourse loan

- Investing in certain collectible NFTs1

6. Financing

Financing within a self-directed IRA is also more complicated for several reasons:

- Typically, a non-recourse loan and larger down payment are needed for any property purchases.

- Unexpected costs and fees can add up quickly and eat into any profits.

- IRA-owned active businesses could run into the issue of UBIT (Unrelated Business Income Tax). This also affects the overlap of bitcoin mining within an IRA.

- Any income and expenses must remain within the IRA structure and never commingled with personal funds. For example, when the water heater goes out (real estate) or salaries need to be paid (businesses), the IRA itself must pay for those services out of the IRA’s own cash. IRA owners could be tempted to co-mingle funds temporarily as they look for short-term liquidity to solve their cash needs.

What does this mean for bitcoin IRAs?

The self-directed IRA space has many potential risks if not properly managed. The IRS and Congress have been paying special attention to how these structures are used and abused. Combine this with their interest in regulating digital assets, and the landscape appears ripe for further scrutiny. With that, bitcoin IRAs need a unique approach that mitigates these pitfalls.

Unchained IRA is not a checkbook IRA

If you’re looking to hold actual bitcoin in your IRA account, you should consider the Unchained IRA. It’s not a “checkbook IRA” where transactions must be self-reported, and Unchained uses its key in the collaborative custody setup to track inflows and outflows of IRA vaults. That visibility mechanism allows the custodian to actively monitor the IRA and therefore allows users to remain compliant with current IRA rules and regulations.

There is no self-reporting required, and the non-checkbook structure helps mitigate the risk of potential pitfalls (McNulty, misreporting transactions, etc.). If bitcoin appreciates like many investors hope and expect, holding coins in an IRA structure properly is of the utmost importance.

This article is provided for educational purposes only, and cannot be relied upon as tax advice. Unchained makes no representations regarding the tax consequences of any structure described herein, and all such questions should be directed to an attorney or CPA of your choice. Jessy Gilger was an Unchained employee at the time this post was written, but he now works for Unchained’s affiliate company, Sound Advisory.

1While not technically part of the Prohibited Transaction Rules (section 4975 of the Internal Revenue Code), collectibles are separately prohibited from being held in an IRA under section 408(m).

Originally published on Unchained.com.

Unchained is the official US Collaborative Custody partner of Bitcoin Magazine and an integral sponsor of related content published through Bitcoin Magazine. For more information on services offered, custody products, and the relationship between Unchained and Bitcoin Magazine, please visit our website.