The UK’s services sector saw a “solid increase” in business activity last month, as well as an uptick in job creation, according to a closely watched survey.

The services purchasing managers’ index (PMI), compiled by S&P Global, rose to 54.3 in January from 53.4 in December.

A value above 50.0 means the sector is growing, rather than contracting. Services PMI has now clocked growth for the last three months in a row.

Last month’s figure was above the ‘flash’ reading of 53.8 in mid-January and suggested the fastest rate of business activity growth since last May.

S&P attributed the strong performance to improved economic conditions, as well as an uptick in sentiment at the start of the year.

The job creation rate was the fastest since last July as stronger order books caused an increase in employment numbers.

However, some survey respondents signalled that wage growth had constrained hiring and made it less likely that voluntary leavers would be replaced.

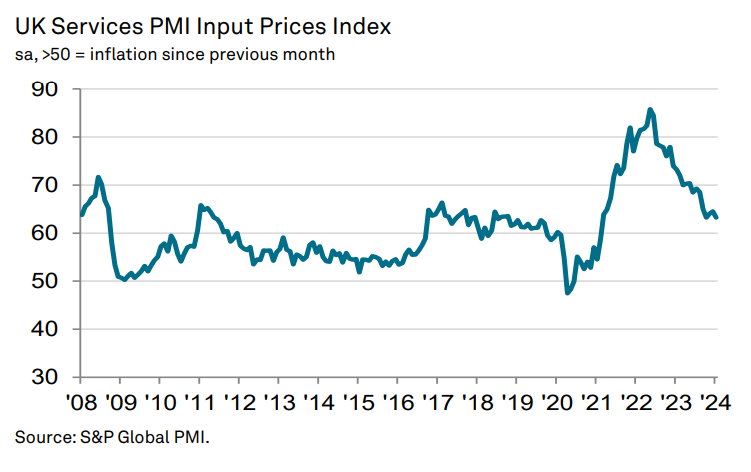

Lower prices for fuel and raw materials helped bring input cost inflation to its joint-lowest level since February 2021, with last October.

“A combination of falling inflation and improving order books provided a strong boost to business activity expectations across the service economy,” said Tim Moore, economics director at S&P Global Market Intelligence.

While companies often said there was greater willingness among clients to spend, some continued to note the impact of cost-of-living pressures on household demand.

Total new work increased for the third consecutive month in January and at the steepest pace since May 2023.

S&P noted a moderate rise in export sales, with stronger demand from Asia and the US partly offsetting subdued conditions in Europe.

Business optimism rose for the third straight month to its highest level since last May as the private sector expected better domestic and international economic conditions.

Moore said: “Another uplift in business confidence in January provides a signal that elevated levels of geopolitical uncertainty have yet to exert much of a constraint on service sector growth projections for 2024.”

Today’s services data contrasts with the weaker manufacturing PMI released last Thursday, dragged by the Red Sea shipping crisis.