As COP28 kicks off its first full week, there are already an innumerable number of headlines to take away from the world’s largest climate round-table.

Here’s a round-up of the three biggest moments from Monday’s session:

Offence is the best defence

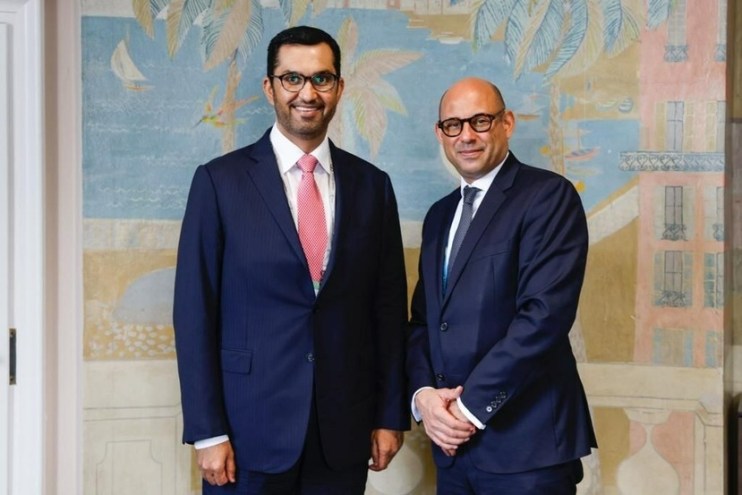

COP28 president Sultan Al Jaber hit back at accusations of harbouring a climate change denier viewpoint.

In an online meeting on 21 November, the oil chief claimed there was “no science out there, or no scenario out there, that says that the phase-out of fossil fuel is what’s going to achieve 1.5C”.

Today in a hastily arranged press conference, Al Jaber said the comments were “one statement taken out of context, with misrepresentation and misinterpretation, that gets maximum coverage.”

He added: “I respect the science in everything I do. I have repeatedly said that it is the science that has guided the principles or strategy as Cop28 president.

“We have always built everything, every step of the way, on the science, on the facts.”

Though it couldn’t be described as a textbook walk back, the president’s comments do throw into further question the summit’s well-documented ties to the fossil fuel industry, Al Jaber himself being the head of the Abu Dhabi Oil company.

With eight days left of the summit, one wonders how many more times Middle Eastern oil interests will come to the fore.

Pull up a chair…

‘Get comfortable being uncomfortable’; no it’s not David Goggins, it was the managing director of investment firm’s KKR’s Global Institute, Neil R. Brown.

Brown was speaking on a panel addressing the investment side of the green transition.

“I think for investors in this space you have to get used to something very uncomfortable, which is being able to navigate these policy frameworks that most of us would prefer to avoid,” he said.

Brown highlighted the difficulties facing those looking to buy into companies working to develop technological solutions to climate change, saying “taking a grant from the department of energy, you have the government, do you really want that? It’s awkward.”

Despite these issues, Brown’s home country of the US is continuing to reap investor confidence and big business interest from the benefits of the inflation reduction act, which is focusing on domestic clean energy investment.

One of the UK’s green energy darlings, IMT Power, which today reported improved earnings following a torrid financial period last year, is eschewing the UK’s clean energy programme and instead eyeing a listing across the pond

Can’t do it alone

Reports on the ground suggest that COP28 has seen a higher turn-out of businesses than usual, possibly marking a collaborative effort involving public and private sectors to tackle global warming.

One man to remind the assembled world leaders of who they need was World Bank president, Ajay Banga who gave an interview on the scale of the resources needed to fight climate change.

He made the commitment that from 2025, 45 per cent of the Bank’s financing annually will go towards climate change initiatives, totalling roughly $40bn a year.

This will come in the forms of capital raising within the G20, shoring up existing balance sheets to free up capital and third-party financing through partnerships.

“But even if I and all the banks and all the governments do all that, you do need the private sector,” he said.

“You’re going to need their ingenuity and technology and numbers”.